inherited annuity tax rate

The estate pays estate taxes and rates vary depending on the size of the estate. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

What Is The Tax Rate On An Inherited Annuity

If you keep the annuity you will usually have to start taking withdrawals from it.

. Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income at their ordinary. You actually have two options if you decide to part with the inherited annuity. So if you have an annuity that promises payments for the next 10 years you could sell five years of these payments.

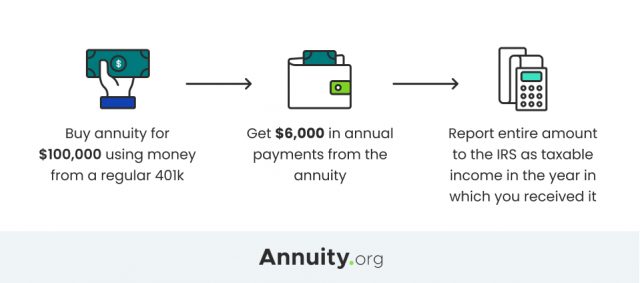

An annuity funded with pre-tax dollars is often a qualified annuity. Withdrawing money from your annuity before turning 59 ½ years old will result in a 10 early withdrawal penalty in most cases. In turn taxation of annuity distributions depends on whether.

The rates for Pennsylvania inheritance tax are as follows. One of the main tax advantages of annuities is they allow investments to grow tax-free until the funds are withdrawn. Only a spouse can inherit an annuity and benefit from the options the late spouse enjoyed.

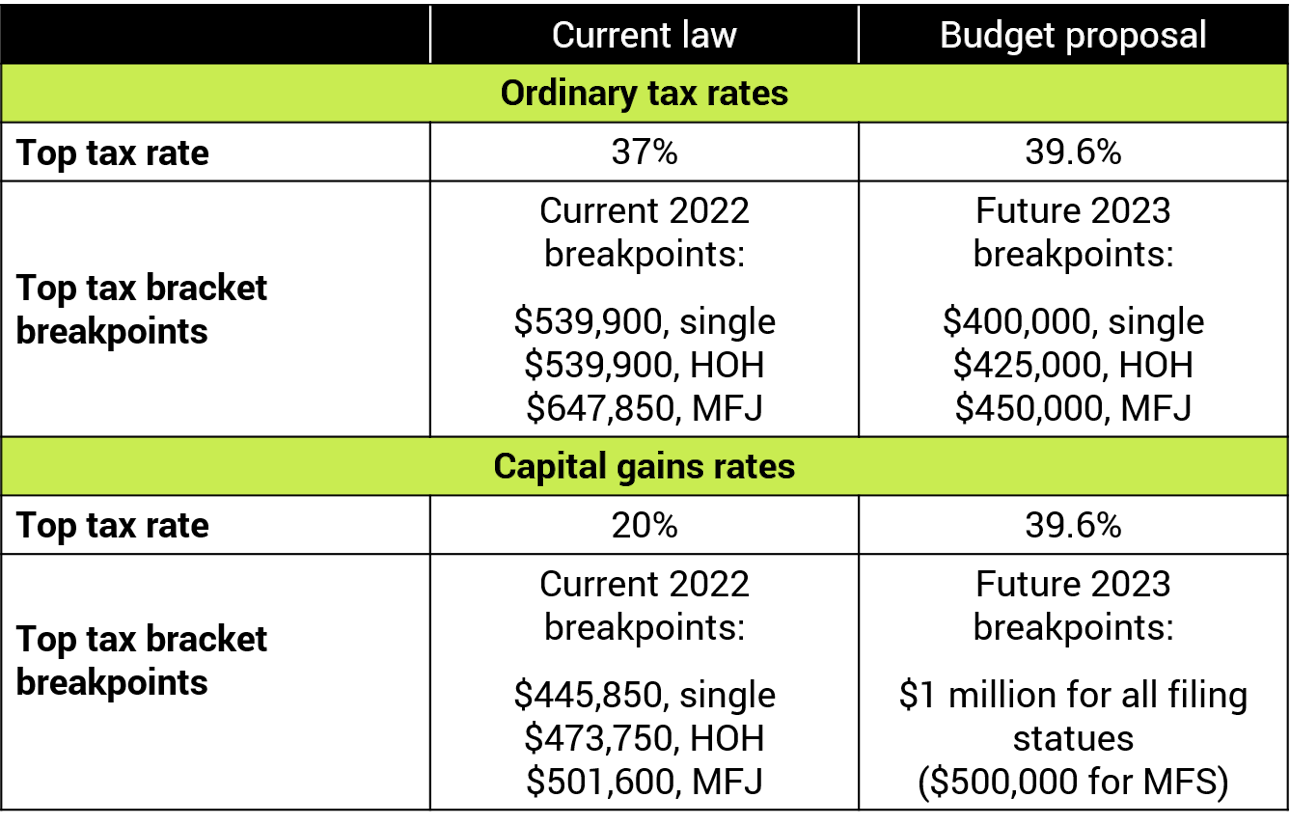

Ordinary income rates go as high as 408 currently 37 plus 38 of Net Investment. Federal tax law only imposes an estate tax on wealth passed down at death. Depending on your taxable income a 10000 gain is taxed at anywhere from 0 to 238 on the federal level.

Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. If you expect to inherit an annuity its important to consider beforehand how that might affect. Inherited annuities are considered to be taxable income for the beneficiary.

Inherited Annuity Tax Implications. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket.

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. Penalties for cashing out an inherited annuity depend on the type of annuity and the beneficiarys age. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death.

A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. If you have a 500000 portfolio get this must-read guide from Fisher Investments. 45 percent on transfers to direct descendants and lineal heirs.

The earnings on an inherited annuity are taxable. Surviving spouses can change the original contract into their own name. How inherited annuities are taxed depends on their payout structure and whether the one.

Either way you will pay regular taxes only on the interest not the principle. If your dad left you an annuity expect to pay taxes at your ordinary income tax rate on the interest but not the premium. Different tax consequences exist for spouse versus non-spouse beneficiaries.

Non-qualified annuities are generally funded with after-tax contributions. The Taxes on the Inheritance of a Tax Deferred Annuity 2. Immediate annuities typically have a 10 early withdrawal penalty if you are younger than 59½.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Death Benefits Payout Options. The tax rate on an inherited annuity is determined by the tax rate of the person who inherits it.

This allows partners to enjoy the same tax-deferred benefits as the original annuity owner. Do I Pay Taxes on All of an Inherited Annuity or Just the Gain. Tax Rate on an Inherited Annuity.

The insurance company. Taxes are due once money is withdrawn from the annuity. How Inherited Annuities Are Taxed.

The earnings are taxable over the life of the payments. Non-Qualified Annuity Beneficiary Taxation. So the tax rate on an inherited annuity is your regular income tax rate.

Ad Learn some startling facts about this often complex investment product. Annuity Taxes for Surviving Spouses. According to the Internal Revenue Service spouses calculate the.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Here you would sell a period of the annuity disbursement or a portion of each payment. Tax Consequences of Inherited Annuities.

For example if your annuity is part of an employer-sponsored retirement plan like a 401k or a SIMPLE IRA you may be able to make pre-tax contributions. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

The first is a partial sale. If the annuity owner still had ownership when he died the value of the annuity is included in his taxable estate. These annuity payments are taxed at your regular tax rate and can be sold wholly or in part for cash-in-hand.

Just like any other qualified account such as a 401 k or an individual retirement account the full value of a qualified annuity which was purchased with funds on which taxes were deferred will be subject to income tax. Once the annuity enters the annuitization phase they must begin paying taxes on earnings as well as any other untaxed portions.

Life Insurance Riders Personal Insurance Life Insurance Policy Mobile Home Insurance

How To Avoid Paying Taxes On An Inherited Annuity

U S Estate Tax For Canadians Manulife Investment Management

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

Withdrawing Money From An Annuity How To Avoid Penalties

Inherited Annuity Tax Guide For Beneficiaries

Taxation At Death Of An Rrif Canada Life Investment Management Ltd

End Of Year Contribution And Distribution Planning For Tax Favored Accounts Https Www Kitces Com Blog End Of Year Contribution Di End Of Year How To Plan Ira

What Is The Tax Rate On An Inherited Annuity

Annuity Taxation How Various Annuities Are Taxed

Inherited Annuity Tax Guide For Beneficiaries

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

How To Avoid Paying Taxes On Annuities Due